A new focus on commercialization is driving collaboration and market opportunities for Brown and Rhode Island.

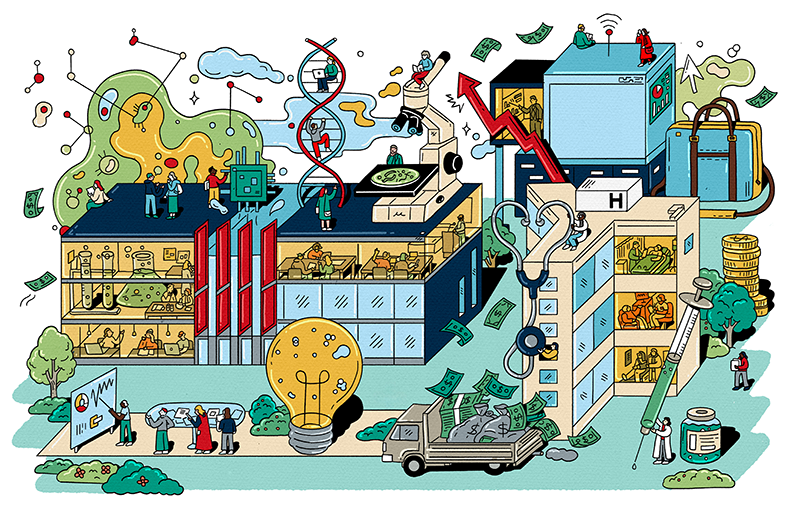

This past October, amid a gathering of entrepreneurs, venture capitalists, industry leaders, and state and local officials, the University celebrated its inaugural Innovation at Brown Showcase. The event, put on by Brown Technology Innovations at Venture Café Providence, featured 25 early-stage ventures—including 16 in biotech—and was designed to highlight inventions, emerging technologies, and potential therapeutic advances led by faculty, students, and alumni.

In many ways, the showcase reflected an important milestone of a 10-year journey within the Division of Biology and Medicine to build a culture of innovation and commercialization that has moved more scientific discoveries from lab to market to help patients. Over the past decade, under the leadership of former medical school dean Jack A. Elias, MD, the Division has invested in the infrastructure—including new departments, processes, programs, and facilities—to advance biomedical discoveries into an era of translational science, fueled by sponsored research, licensing agreements, and the creation of start-up enterprises.

“Brown has always been a school with a great academic fiber to it, where science for the sake of science was pursued,” Elias says, “but it hadn’t focused as much on translational or disease-focused research that might lead to new treatments in five, 10, or 20 years from now.”

That has changed significantly under Elias and current Dean of Medicine and Biological Sciences Mukesh K. Jain, MD, and reflects a broader trend among academic research institutions. Increasingly over the past few decades, universities have come under mounting pressure from federal, state, and municipal entities to demonstrate a positive impact on public health, job creation, and economic development as a return on investment for the billions of dollars that funnel annually into scientific research.

According to the National Center for Science and Engineering Statistics, of the nearly $90 billion spent by academic institutions in fiscal year 2021, more than half came from federal sources, including $27.5 billion to support research and development in biomedical science, life sciences, and medical technology.

“Historically, medical schools taught people destined to become great clinicians, who are wonderful and valuable,” Elias says. “But we often lacked great treatments that were effective and helpful for common diseases. We owe that to patients and society—and we need physicians involved in the research process.”

Go Team

The movement toward translational science was a trend Elias had seen growing throughout his more than three decades as a physician-scientist with a focus on lung diseases. During his 23 years at Yale, Elias watched a culture of entrepreneurship and commercialization take off—fueled by public and private venture capital funds to support the foundational building blocks, like incubator and accelerator space, to create a vibrant life sciences and medical technology ecosystem.

When Elias arrived at Brown in 2013, his long-term vision was to transform the culture of siloed research into team science. “A team focus brings together people with complementary levels of expertise, which allows them to move [discoveries]forward in an expedited fashion,” he says. “That meant getting the basic scientists and clinicians to work more closely together.”

But Elias did more than champion that approach; he modeled the way. In 2019, Elias; Jonathan Kurtis ’89 PhD’95 MD’96, the Stanley M. Aronson Professor and chair of pathology and laboratory medicine at Brown; and entrepreneur Chirinjeev Kathuria ’88 MD’92 founded Ocean Biomedical, which went public last year. The company works with scientists and research institutions worldwide to develop new medicines.

Jain has continued Elias’ efforts to bring researchers together. He says Brown has all the right elements to go from “pipette to patient to policy,” when the work of the Brown School of Public Health researchers is included in the cycle. Changing the culture of Brown to think more entrepreneurially “will stimulate stronger partnerships with biotech and pharma, which will accelerate the timeline to clinical impact while simultaneously enhancing economic vibrancy and workforce opportunities for our Rhode Island community,” he says.

Jump Start

The increased focus on integrated teams and commercialization also has helped attract additional research funding—and private investment—for BioMed research, which Elias says has more than doubled over the past decade. Some of that investment—$8 million—came from alumni who helped establish a pool of seed money, called Brown Biomedical Innovations to Impact (BBII), to support the development of early-stage technologies and therapies discovered at Brown.

The fund, which awards up to five $100,000 grants annually to research projects with commercial potential, is overseen by Managing Director Karen Bulock, PhD. “These funds allow researchers to further develop their technology [or therapeutic]to the point where there might be a potential licensing opportunity or interest [from outside investors]in providing additional capital,” she says.

Since its founding in 2018, BBII has funded 21 proposals—a total of $2.1 million—from 19 faculty members. Of those awarded ventures, four have formed start-up companies, which have collectively raised an additional $3 million in seed funding.

One of those companies is Providence-based XM Therapeutics, founded in 2019 by Jeffrey Morgan, PhD, the Donna Weiss ’89 and Jason Weiss Director of the Center for Alternatives to Animals in Testing. The company, which is in a preclinical phase, is focused on improving the health of patients with chronic disorders by modulating and repairing the extracellular matrix. The ECM provides the structure upon which human tissues are organized—and plays a critical role in wound healing. However, a dysfunctional ECM can cause scarring and can contribute to inflammation, fibrosis, and poor oxygen levels.

Under XM’s technology platform, particles from a decellularized ECM can be injected into a patient with the goal of repairing the damaged tissue and preventing scarring. The therapy, if it proves effective, could potentially treat numerous chronic health conditions, including heart failure, pulmonary fibrosis, liver disease, and kidney failure.

In addition to supporting XM Therapeutics with seed money, Brown, through its Entrepreneur Connect program, helped to identify a CEO to pair with Morgan to officially form the start-up company. “We needed to create a company in order to raise the capital necessary to [advance]further down the drug development pipeline,” says Morgan, a professor of pathology and laboratory medicine and of engineering.

Connecting teams to experts is invaluable, he adds: “In the drug development process, [a start-up]needs biotech expertise including regulatory affairs, clinical trials, and manufacturing.”

A Stately Affair

The University’s expanded role in translational research and commercialization is also part of its goal to increase its contributions to Rhode Island’s broader economic development. From 2018 to 2022, Brown invested more than $341 million in the Jewelry District, home to The Warren Alpert Medical School, which has evolved into an innovation epicenter.

“Partners like Brown University are incredibly valuable to how the state engages in this ecosystem,” says Elizabeth Tanner, JD, the Rhode Island secretary of commerce. The University is a key participant on both the state’s Science and Technology Advisory Council and the new Rhode Island Life Sciences Hub.

It’s part of a concentrated effort by state officials to draw more federal and venture capital to Rhode Island, attract and retain a highly skilled workforce, expand life sciences partnerships and research and development, and foster markets for medical technology and therapeutics. The state is well positioned—with Brown as an anchor institution—to take advantage of the $4.1 trillion economic corridor represented by the northeastern US, Tanner says. Rhode Island received the third most NIH funding per capita of any state in 2022. The Ocean State also ranks second in STEM degrees and fourth in patent technology diffusion.

The state has instituted a number of programs to continue to grow its life sciences ecosystem, including its Commerce Corporation Innovation Voucher Program, which provides up to $75,000 for companies to conduct research and development at key phases of their growth trajectory. While some companies do R&D in house, several outsource this function to research institutions like Brown.

“This collaboration has helped Brown-led innovations take root and helped companies tap into Brown-led research to continue to develop their products,” Tanner says. One example, she notes, is Kardio Status Inc., co-founded by Anshul Parulkar ’10 MD’18 RES’21 and Clinical Assistant Professor of Medicine Antony Chu, MD, MBA. The company, which has advanced biometric signal processing algorithms using novel machine learning technologies, received $50,000 in voucher funding earlier this year.

Since 2016, Brown has been the knowledge partner in 14 program voucher-backed projects, including five that are bioscience-related, according to Tanner. Additionally, the state matched NIH Small Business Innovation Research and Small Business Technology Transfer seed funding. Of the 88 companies to receive this funding, nearly two-thirds supported life science or medical technology ventures.

Tech Innovators

Fostering industry engagement and forging strategic partnerships primarily falls to Neil Veloso, MBA, and his Brown Technology Innovations team, who oversee key commercialization functions such as industry-sponsored research agreements and intellectual property protections, and harness resources—like venture capital or accelerator programs—for start-up ventures spinning out of Brown.

Veloso, the executive director of Brown Technology Innovations, says its aspirational goal is to achieve what he calls the commercialization “grand slam.” “That means it’s a faculty start-up, based around Brown technology, venture capital-backed, and located in Providence,” Veloso says. “If we hit those four [components], it can really impact our efforts to grow innovation.”

Over the past three fiscal years, Brown has executed nearly 40 sponsored BioMed research agreements, secured 24 BioMed-related patents, and inked more than 60 biotech licensing deals. “There’s been a culture shift from external parties, including investors and companies, who want to work more closely with Brown faculty in early phases,” Veloso says.

A key partner to Veloso’s team is BBII’s Bulock, who before coming to Brown was involved in research project management with large pharmaceutical companies for more than 20 years. Bulock says the growth of university-originated start-ups has evolved over time; traditionally, the movement of technology out of a university was more direct.

“The technology would be developed to a certain point and licensed to a third party, either a pharmaceutical company or device company,” she says. “Today, there’s [often]a gap between when a company might want to license [a technology]versus when it’s ready to move out of the university, so the start-up step allows the further development of the technology.”

A key consideration within Brown’s innovation ecosystem, Bulock says, is whether the discovery will provide a groundbreaking new way to solve a problem. “The goal is for the technology [or therapeutic]to meet an unmet need,” she says. To help assess market opportunities, provide input on seed funding, and help connect researchers and faculty with capital networks, BBII has an advisory board composed of executives from health care, pharmaceutical, and venture capital industries. “They help us prioritize which proposals likely have the best chance to be successful,” Bulock says.

One of those proposals, which BBII supported in 2019, was a medical device that makes it easier to stabilize feverish infants who must undergo a lumbar puncture to test for meningitis. The product, which has since spun out of Brown into a start-up venture called SMöLTAP, was the brainchild of co-founders Brian Alverson, MD, a former Medical School professor now at Nemours Children’s Hospital in Delaware, and Ravi D’Cruz MD’13 RES’16 F’19, a neonatologist in Washington state. Bob Cooper, MBA, the CEO of

SMöLTAP, says traditional standards of care for infant spinal taps involve medical staff holding infants in an unstable side-lying position, which can create stress on the infant and variability in successful spinal taps. NIH data found failure rates for lumbar punctures of up to 40 percent, with an average cost of $5,000 tied to spinal tap complications and failures.

The SMöLTAP device is a seat that tips an infant’s pelvis to open the spine more and includes a headrest—like a massage table—and straps to secure a baby’s head and body. Over the past four years, the company, with an additional $500,000 in seed funding from angel investors, evolved the prototype design and tested the product in select hospitals to get continuous feedback. Preliminary pilot data from Toronto’s Hospital for Sick Children showed failure rates for infant spinal taps using SMöLTAP declined by 30 percent.

Cooper says the company, which owns three patents on the device technology, started manufacturing its first product run in the summer of 2022, and sold its first product in January 2023. While the company has since contracted with dozens of hospitals—including the Children’s Hospital of Philadelphia, Stanford Medical Center, and the Mayo Clinic—widescale adoption of the device faces standard challenges of bringing innovation to market, Cooper says.

“The sales cycle for a new medical device is [typically]between 18 and 24 months,” he says. “Educating doctors and nurses [about the product]and changing the standard of care is a process.”

He says the culture of innovation and partnership between health care professionals and universities is important and growing. “Doctors and nurses see problems firsthand and realize there’s an opportunity to develop ways to fix them,” Cooper says. “We’re seeing more of that.”

Fertile Ground

In 2019, relying on research discoveries from two Brown labs, Johnny Page ’18 ScM’19 MD’26 co-founded Bolden Therapeutics, a start-up focused on neurogenesis, the formation of new brain cells. The research has potential implications for a number of brain-related conditions, including depression, traumatic brain injuries, and Alzheimer’s disease.

Bolden’s founding—which has attracted more than $4.5 million in public and private capital—was built upon the fusion of research tracks from two faculty cofounders: Justin Fallon, PhD, professor of medical science and of psychiatry and human behavior, whose work relates to identifying new pathways important in neurological diseases; and Ashley Webb, PhD, a former Brown professor now at the Buck Institute for Research on Aging, who studies factors that regulate stem cell activity and help shape neurogenesis.

Early after its founding, Bolden received a $500,000 grant from the NIH and won a Golden Ticket Contest sponsored by the pharmaceutical company Biogen. This award provided the company with a year of sponsored lab space at the Cambridge, MA-based LabCentral incubator. “These spaces have all the specialized equipment [a start-up]could possibly need,” Page says. “It allows a company to focus on its research.” These awards jumpstarted Bolden’s research and enabled the company to attract private investment and win additional awards to support its R&D.

Page says he would have preferred to keep the lab in Providence, but comparable incubator space did not exist at the time. But that is rapidly changing. Last June, the state legislature allocated $45 million to create the Rhode Island Life Sciences Hub. Funds will support the development of high-demand wet lab incubator space, as well as grants, loans, and business development. Brown President Christina H. Paxson and Dean Mukesh Jain are on the board that will oversee the life sciences hub.

Page says Brown and Rhode Island’s progress in commercialization has been impressive. “It takes time to get initiatives launched, and a lot has come online over the past three or four years,” he says, noting the culture of collaboration and innovation that has taken root over the past decade.

“Ultimately, what we want is for our discovery to make the broadest impact possible,” he adds. “Brown is creating a new precedent for what’s possible, and they’ve done a great job inspiring students and faculty to bring solutions to market and launch companies.”

- Last fall, Brown became a “spoke” of the new Investor Catalyst Hub, part of the federal health innovation network ARPANET-H. The hub, based in Boston, aims to accelerate the development of health care solutions. Dean Mukesh K. Jain, MD, worked with the Brown Technology Innovations team to apply for the University’s membership in the group.

“Being a part of the Investor Catalyst Hub offers access to funding from the federal government as well as private sector connections,” Jain says. “It provides faculty researchers access to advance information on potential new ARPA-H programs where funding may